child tax credit portal update dependents

File a federal return to claim your child tax credit. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov.

. Use the IRSs Child Tax Credit Update Portal to. The credit is often linked to the number of dependent children a taxpayer has and. Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account.

Filed a 2019 or 2020 tax return and. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child. Single or married and filing separately.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. For children under 6 the amount jumped to 3600. This section will help you identify Child Tax Credit payments you have received and tell the difference from other tax benefits.

The IRS will pay 3600 per child to parents of young children up to age five. The Child Tax Credit Update Portal allows people to unenroll from. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased.

The IRS will add more features. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021.

O Check if youre enrolled to receive advance payments o Unenroll from advance payments of the Child Tax Credit o Update or provide. Half of the money will come as six monthly payments and half as a 2021 tax credit. You can use the IRS Child Tax Credit Update Portal to view your payment history and verify that a check has been mailed to you or that you have received direct deposits.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit. You can use your username and password for.

Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Because of this if you expect your situation to change in 2021 you will have to update this via the IRS Child Tax Credit Update Portal IRS CTC UP. A child tax credit CTC is a tax credit for parents with dependent children given by various countries.

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. You can use it now to view your. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Simple or complex always free. If you received direct deposits to your bank account.

Have been a US. Visit ChildTaxCreditgov for details. 932 ET Jul 6 2021.

The American Rescue Plan passed in March expanded the existing child tax credit adding advance monthly payments and increasing the benefit to 3000 from 2000 with a. Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. THE IRS has launched child tax credit online portals that will help parents to get the extra stimulus money when the monthly 300 payments begin.

Your advance Child Tax Credit payments were based on the children you claimed for the Child Tax Credit on your 2020 tax return or 2019 tax return if your 2020 tax. Child tax credit portal update dependents. Find details on the IRS.

To apply applicants should visit.

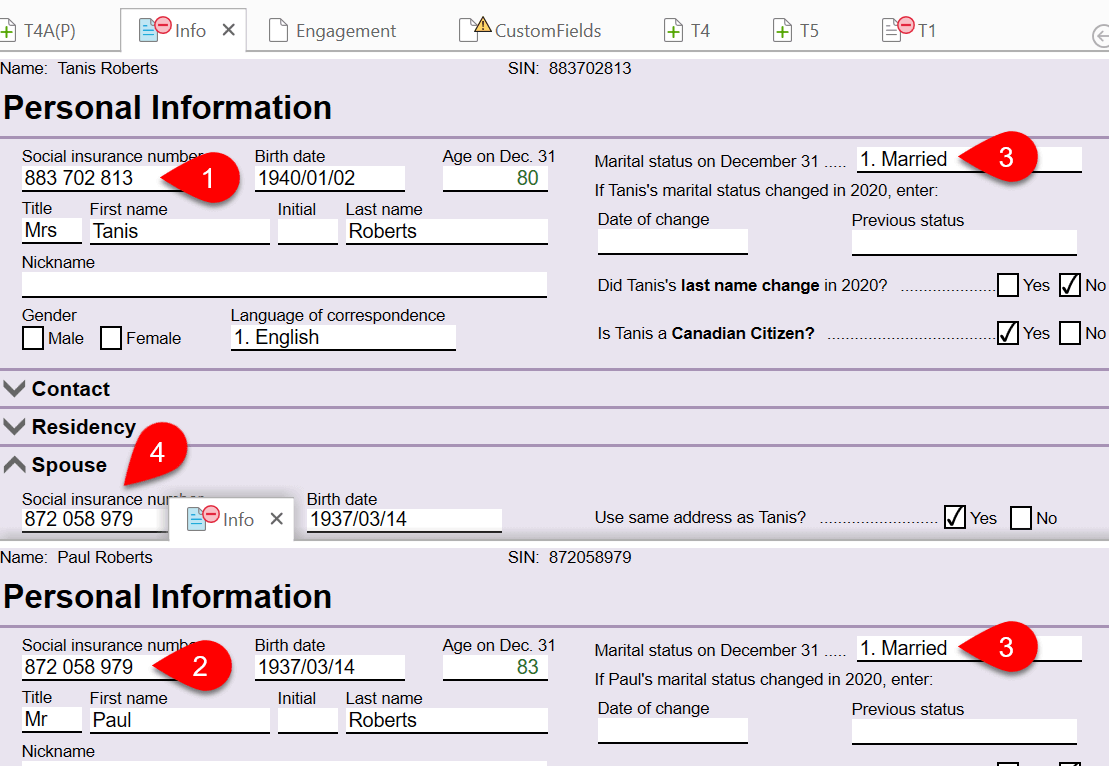

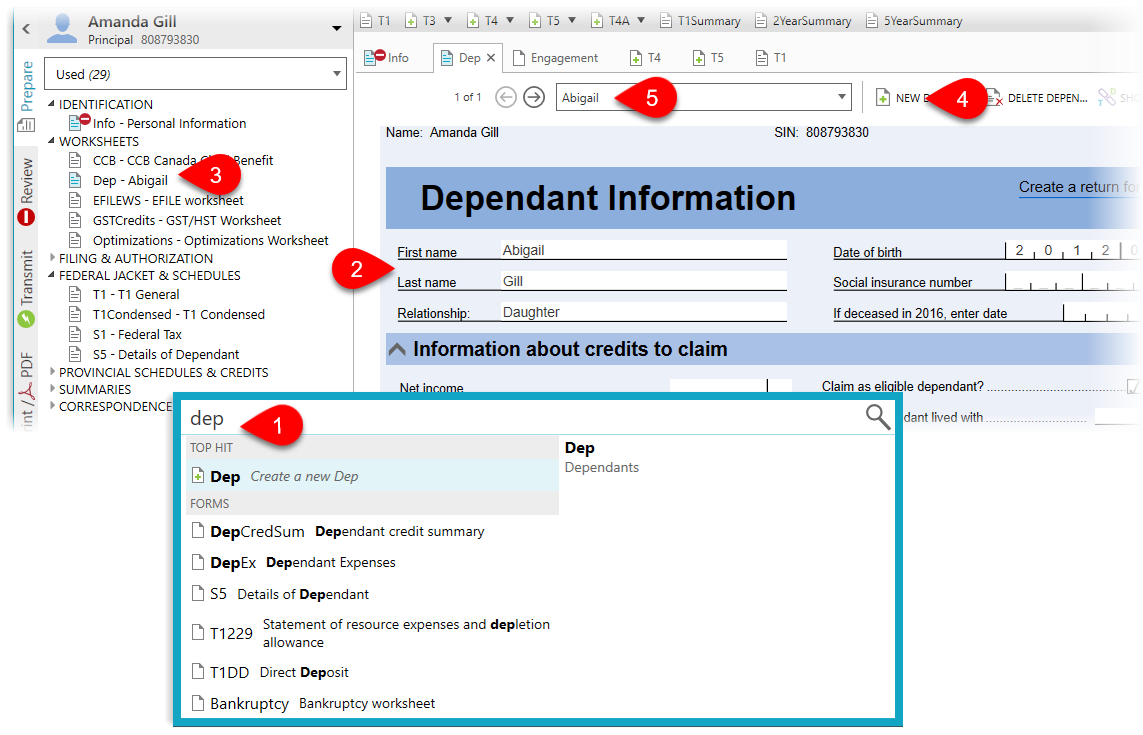

Dependant And Family Returns Taxcycle

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

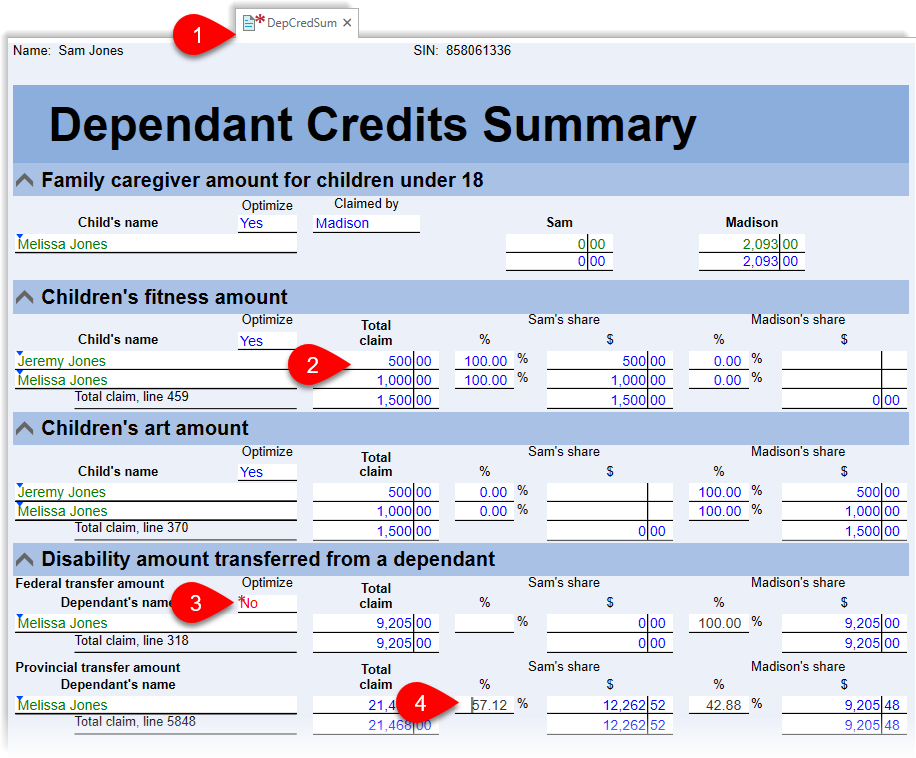

Dependant Tax Credits Dep Depex Depcredsum Taxcycle

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Dependant Tax Credits Dep Depex Depcredsum Taxcycle

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)